Is it Blinker or Sinker Time for $TLRY ?

While many of the meme stocks have had a pretty boring calm break ( GME 0.00%↑ looking at you) the cannabis sectors has had a hot girl summer with President Trump’s recent announcement that he is looking into rescheduling Cannabis from a Schedule 1 substance, meaning that the Federal government currently sees no medical value despite the mountain of evidence to support weed’s medicinal uses. For reference Meth and Heroin both are schedule 2 substances.

Thus the Cannabis sector tore a full bull run into August 11th, 2025 while the rest of the market slumped into the dog days of summer. Of the Cannabis companies, Tilray TLRY 0.00%↑ found itself in a strange position. On the heels of lack luster performance of the market price, Tilray was trading between the 0.40 - 0.60 range leaving them out of compliance with NASDAQ. On June 10th, the company released the results of a special shareholder’s meeting that passed an amendment to enact a 1:10 to 1:20 Reverse Split.

Then came President Trump announcing his intentions to make Cannabis descheduling an issue on his desk in light of the recent DEA reviews and the cannabis sector responded by rising like Atlantis from the ocean floor to the highs that it hasn’t seen all year taking Tilray along for the ride. For good reason as well, President Trump’s support of rescheduling and the Safe Banking Act could bring stability to a sector ripe with uncertainty.

Currently Tilray trades between 1.00 - 1.15 and this marks an almost 100% return for swing traders from summer lows, however many long time Tilray investors have yet to see a positive return on their investment.

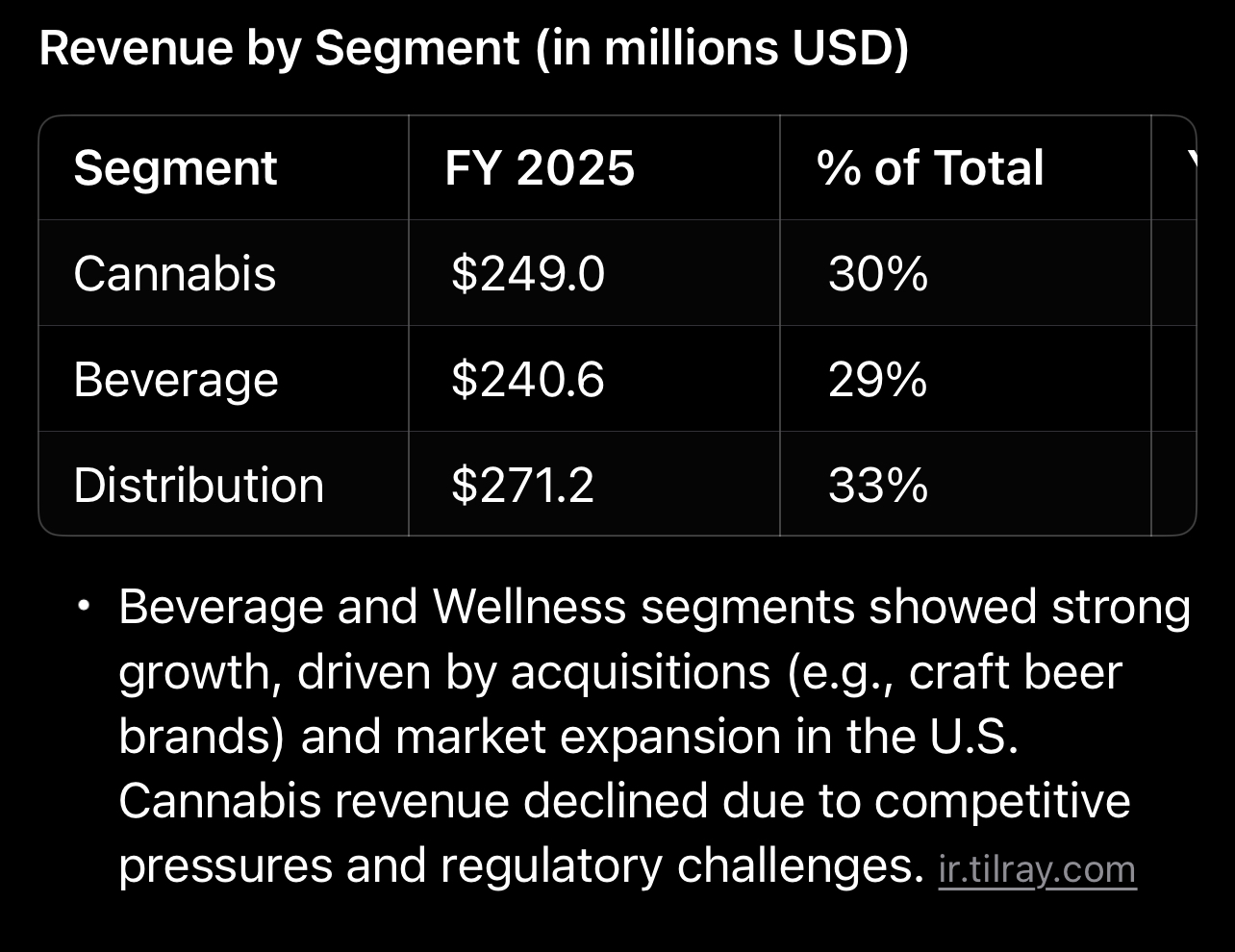

IMHO Tilray is a strong leader in the Cannabis sector, with its diversification into alcohol and cannabis beverages where beverage revenue is up 19% YoY to $240.6M, making it 29% of total revenue. Revenue on the whole is also up, showing a 4% increase YoY. This Canook cannabis company just might have legs. However the potential Reverse Split becomes a dark cloud in an otherwise puffy white clouded room.

Looking into the past, Tilray beat EPS expectations in key quarters and is on trend to turn positive this coming October. That’s a trend One can put into their pipe and smoke that good stuff.

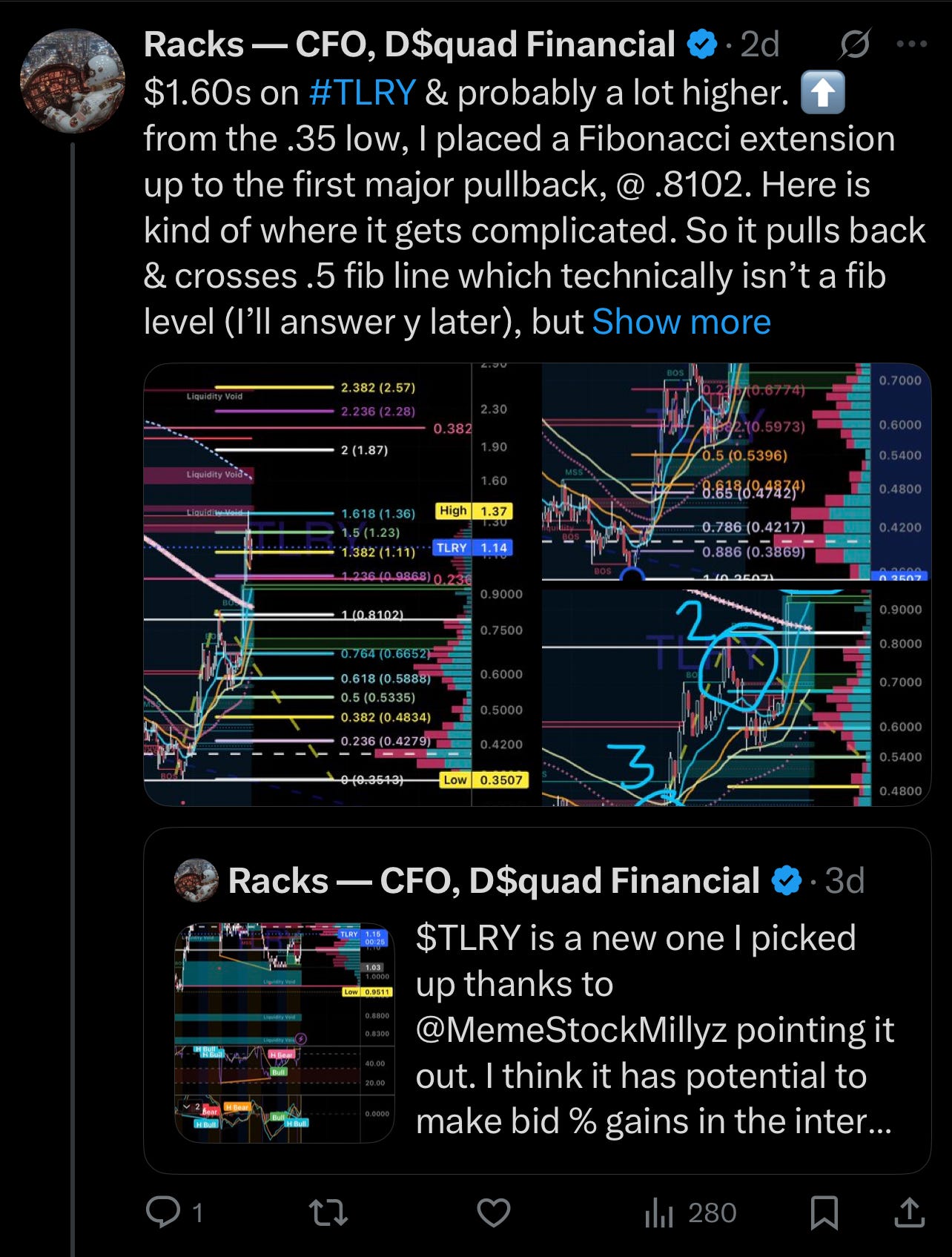

Fellow D-Squad member Racks lays down some heavy TA seeing above 1.05 as bullish and dropping below the 0.96 support as bearish with his signature Harmonics showing vast uppie potential. My own rudimentary TA is looking towards the golden cross forming on the 50 and 200 Day Moving Averages as they both pull into a bullish upward trends.

For now, Tilray is on the clock. After today, 3 more days staying above the $1.00 mark will place the company back into NASDAQ compliance.

As for my own exposure, I took the bait around the 1.10 mark and anyone who has notifications for my X account were able to scoop up a lower average in the days that followed.

If One keeps the notifications on, then One will be kept up to date with this trade as I always post my entries and exits of the trades within 15 minutes of the transactions on the plays that I’m public about.

Ultimately will Tilray be a blinker or sinker, only time will tell. Let me know what you think in the comments. However in either case, I’m not only an investor but also a consumer.

Keep it lit and stay elevated, Fam!